Our History

Our Founders

A Legacy of Adventure and Innovation

Born to parents Harvey M. Templeton, Sr., and Vella Handly Templeton in the early 1900s, our two patrons, Harvey M. Templeton, Jr., and John M. Templeton, quickly developed as children a love for adventure, learning, and discovering the wonders of nature.

For Harvey, his curiosity as a child was piqued by science while wiring his father’s rental homes with electricity and building radios, and for John, his entrepreneurial spirit was kindled by first selling vegetables from his mother’s garden and then later fireworks he imported to his classmates at school.

While the two brothers both carried a lifelong sense of adventure and a love of learning, they manifested differently.

Harvey M. Templeton, Jr.

Pioneer and Visionary

In Harvey’s case, beginning college at Yale University and later finishing at the University of the South: Sewanee, when the Great Depression arrived, led to an across-the-United States motorcycle trip and adventures in mountaineering, where he and his wife, Jewel Templeton, made the first ascent (alongside famed mountaineer Glen Exum) of what is now called “Templeton Crack” on Symmetry Spire in the Grand Teton National Park.

Revolutionizing Horticulture

When Harvey and Jewel settled down to raise a family of five children in Winchester, he turned his attention to founding and growing a sprawling plant nursery that became famous for his ground-breaking invention of the “electronic leaf” mist propagation system in 1955. The electronic leaf system combined Harvey’s knowledge of electrical engineering and horticulture to create a device that detected the presence of water on a screen near the planted root cutting. When the water evaporated and the weight of the screen changed, a solenoid switch activated the mist sprinkler. His invention was widely adopted and led to a significant expansion of the overall nursery industry. Named the “Phytotektor,” Harvey’s invention led to faster plant growth, healthier plants, and the automation of plant propagation meant that it could continue at all hours of the day and seasons of the year–vastly increasing productivity and profits. Harvey’s success with the Phytotektor propelled him to a leadership position in the industry, including service as President of the International Society of Plant Propagators in 1961. Before long, though, Harvey was ready to move on to new pursuits and sold his successful business to a local competitor in 1968.

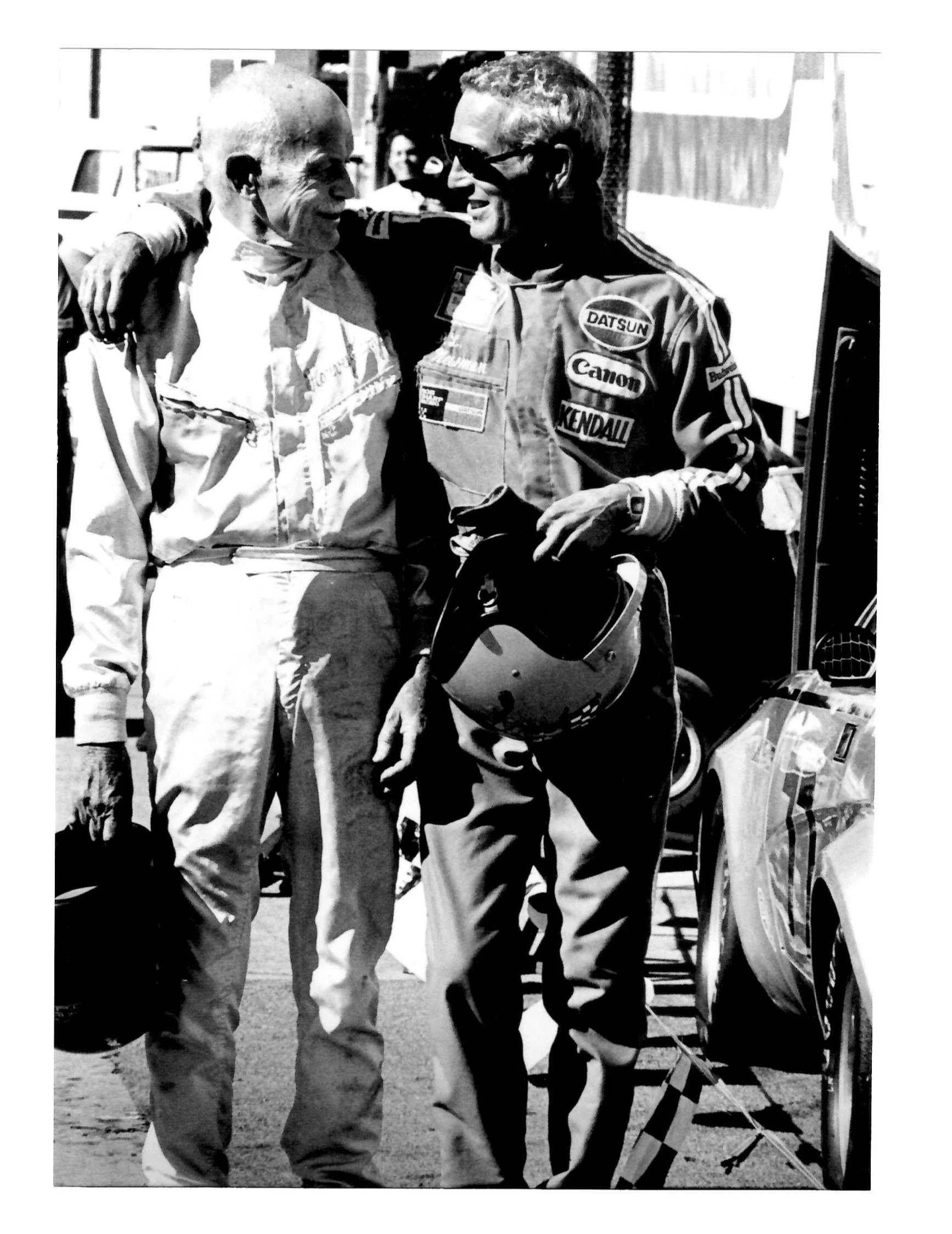

A Racing Innovator

It was in the same year that Harvey, at nearly sixty years old took up competitive race car driving. Beginning in the Formula Vee class, and competing with drivers at least 30 years younger, he was determined to win, but in order to win he needed a car meeting all specifications for the class that simply went faster. With that in mind, he set out to design and build just that car. After careful study of the history of race car design, including the mathematics underlying speed, air resistance, and horsepower, Harvey concluded that the Formula Vee was an underpowered vehicle that needed a major reduction in air resistance to increase its speed. Applying ideas from aerodynamics, he drastically reduced the air resistance surrounding the nose of the vehicle, but also in a stroke of genius created the first concept and application of zero-roll suspension in the Formula Vee’s rear wheel base. This zero-roll suspension allowed the rear wheels to operate independently of each other and the car to corner faster without sacrificing speed. Harvey introduced his design and self-made Formula Vee, which he named “Shadowfax” on the racing circuit in 1970 and it was an instant success. Harvey competed in the championship races from 1970-1974, winning 8 national races and taking the pole position 9 times in 1974 alone. It was also during this time that he was approached by a newer driver on the circuit who introduced himself as Paul Newman, and an admirer that wanted to emulate Harvey’s racing abilities at an older age. Always polite, Harvey spoke with Mr. Newman and sought to learn more about him, including what he did outside of racing. Harvey sold the Shadowfax that same year, but was not quite done with racing and proceeded to build another innovative car, the "HR7260" Formula Ford, named after the House of Representatives bill that established Social Security. Its distinctive cigar-shaped body and side-mounted horizontal radiator were bold departures from the pointy-nosed designs of its contemporaries. After Mr. Templeton retired from racing, his son, Handly, continued to race the HR7260 for several more years. Today, the car is part of the prestigious collection at the Barber Motorsports Museum in Birmingham, Alabama. Harvey stayed active designing, building, and even winning car races into his early 80s.

John M. Templeton

A Maverick of Wall Street

If Harvey’s sense of adventure took him to mountaintops, success in business, and racing cars, his younger brother, John took a maverick’s approach to investing and summited the heights of Wall Street.

Education and Global Perspective

Like Harvey, John Templeton attended Yale University, but when his father wrote him before his sophomore year and told him he could no longer support his education due to the Great Depression, John found part-time jobs, any scholarships available, and made up the difference through steady winnings at the poker table from his classmates. Later, John concluded in hindsight that losing the financial support of his father towards his education was the greatest blessing, because it forced him to work harder, rise to the top of his class, and earn a Rhodes Scholarship. By the time John completed his graduate studies at Oxford he was certain of two things, one was that he wanted to become an investment counselor on Wall Street, but before returning home, he wanted to see the world. From Oxford, John and a friend set out to visit 27 countries on a shoestring budget of personal savings. It was this travel experience as a young man that set the foundation for the man that would become the world’s first and foremost global investor. While at Yale, John had noticed that his classmates only invested in and discussed U.S. stocks, which he found short-sighted or even arrogant. His reasoning was that an investor willing to look outside the U.S. could find additional opportunities to enhance their returns. While the investment world presents a challenging career path, John had an auspicious start.

Transforming Investments

Shortly after beginning his career, he spotted an opportunity where few investors had the courage to look–a strategy that would become his trademark. With the German invasion of Poland in 1939, the U.S. markets went into sharp decline, still reeling from the Great Depression and anxious over the advance of Nazi Germany. John’s view, however, was that the U.S. would be drawn into the conflict and that its economic activity would rebound sharply through the industrial demands of a wartime economy. With this view, he borrowed $10,000 from his former boss and ordered his broker to purchase stocks on the U.S. exchanges trading for less than $1.00, many of which were in bankruptcy. The broker discouraged John’s order, but the purchases were made. Following U.S. involvement in the War, its economy had rebounded and in a few years' time, John’s initial $10,000 had grown to $40,000. After selling his stock and repaying the loan, John then parlayed his funds into buying out an investment counselor business whose founder was seeking retirement.

-

Shortly after the start of his firm, the mutual fund became a new product available to U.S. investors and John enthusiastically added these products, becoming a pioneer in mutual funds, including funds with global investments outside of the U.S. John believed that mutual funds were essential to the long-term success of the U.S. since they enabled all members of society the ability to participate in the American dream. In the following decades, John’s talents, mutual funds, and firm became well known on Wall Street, growing to become the tenth-largest investment management firm in the U.S. Still though, he felt something was missing. While he had become wealthy, he was taking an increasing interest in his spiritual well-being, and wanted to spend the rest of his time and focus on nurturing his spiritual health and those of others. So, in the late 1960s, he and his wife Irene sought change. After careful research, they decided to move to the Bahamas, seeking its natural beauty and the fact that, based on his research, it had more per capita churches than any other nation.

A Life of Philanthropy

Before the move, and while still a U.S. citizen, John sold his investment management business to a life insurance company and paid all taxes on the sale. Interestingly though, the life insurance company bought the entire firm except for one small Canadian-based mutual fund, called the Templeton Growth Fund. Because it was based in Canada, the life insurance company saw it as a bad match for its U.S. clients due to cross-border tax reasons, so John agreed it would not be a part of the sale and he would simply manage it on behalf of its few clients in his retirement. The rest, as they say, is history. Some time after John moved to the Bahamas (where he became a citizen of the U.K.), the president of the life insurance company (John Galbraith) contacted him, requesting a meeting. During the meeting, Mr. Galbraith told John that the life insurance company was relocating to California, but he did not want to move his family from New York. Instead, he was interested in purchasing the Templeton Growth Fund, and its strong track record for him to manage and market. John was flattered but offered a counterproposal to Mr. Galbraith, saying that instead, he could market the fund to new investors for compensation and, if it went well, could come in as a partner. It went well.

-

During the 1970s, with the U.S. markets in a severe downturn, John’s prescient investments into Japan (in the wake of its post-war ruin during the 1950s) began to soar in value due to its growing industrial might. Based on the Templeton Growth Fund’s track record, which was quickly becoming the best in the markets, and John Galbraith’s marketing, the roughly $8 million Templeton Growth Fund spawned the Templeton Funds, a $22 billion mutual fund empire that John sold to Franklin Resources in 1992. Not a bad second act for a retiree in his 70s and 80s. Yet, again, and despite the unexpected windfall, John’s thoughts were focused on his philanthropic pursuits into spiritual progress. By then, he had already been funding the Templeton Prize, one of the world’s largest cash prizes, awarded to people exemplifying progress in religion and spirituality since 1972. He also endowed the first business school at Oxford University, named Templeton College, and was knighted by Queen Elizabeth II for his philanthropic generosity in 1987, the same year that he founded the Templeton Foundation. While his talents as an investor remained nearby, he spent the rest of his life energized towards generously giving to and guiding the future work of his philanthropies, where he eventually left much of his wealth. We encourage you to take a look at the awe-inspiring work of the John Templeton Foundation and its sister organizations, the Templeton World Charity Foundation, Inc., and the Templeton Religion Trust.

The Templeton Gardens Leadership

Today, the Templeton Gardens represent the gratitude that both Harvey and John felt towards Franklin County, a community that nurtured early their character, sense of purpose, and adventure. The Gardens are managed and overseen by Harvey and Jewel Templeton’s children, who grew up more like siblings with John’s children (first cousins) spending summers together in Tennessee following the untimely death of John’s first wife.

The Garden Directors

Pictured L-R

Handly C. Templeton (Director, with Mary Handly Templeton-Phillips), Harvey M. Templeton III (Director), Becky L. Templeton (Spouse), Jill T. Sideman (Director), Avery T. Lloyd (President), Ann T. Cameron (Director), and Becky M. Templeton (Spouse of Handly C. Templeton).